4 Payroll Procedure and Control Problems Often Experienced

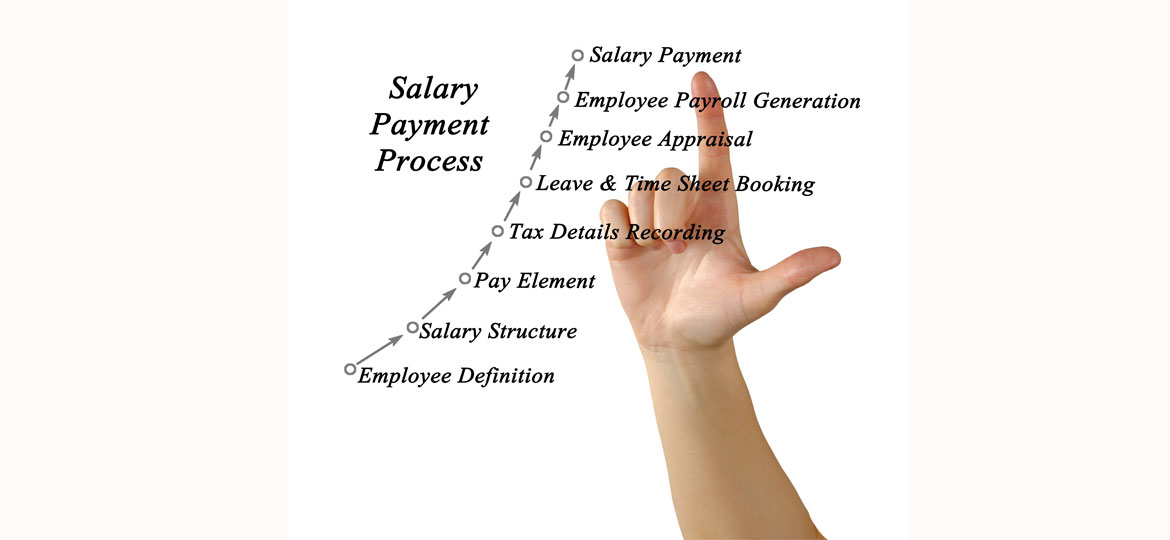

Payroll procedures and controls - Employees are one of the important components of a company because they are the human resources that drive the wheels of your business company. To be able to achieve this goal, of course the human resources owned by your company must be of high quality and productive. To increase employee productivity, you can use the best payroll system or software so that this payroll can run smoothly and on time.

The cost for this payroll is the biggest cost for the company so it is important to control it properly. There are several problems with payroll procedures and controls that are important for you to know about the following:

Attendance

The first problem is attendance. To be able to pay these employees' salaries you must look at their attendance. The employees who work hard with those who rarely work will certainly have different salaries. If a company with a small scale or an SME might not object to this attendance, but for this large scale company many have problems with the attendance system.

To be able to create payroll procedures and good control, it is important for you to integrate this payroll software with an employee attendance system. Transparency and accuracy in this attendance system are needed to create a much better payroll.

Overtime Hours, Leave, Bonuses and Benefits

The next problem that often occurs is calculating overtime hours, leave, bonuses and allowances. The calculation of overtime hours is often a problem because each employee has different overtime hours.

For leave, the problem that often arises is the status of leave, therefore the unclear status of employee leave must be resolved. In addition, when on leave, what about the salary, whether they are free from salary or get a salary. If it is adjusted to the Law, employees are on leave outside the company's responsibility.

These bonuses and benefits are not much different and bring complexity and can be resolved with a digital system. If the company is multiple levels of management it will take your time and energy too.

Transfer System

If the company is still on a small scale, payment by cash is not a problem, but if it is a large scale company with a large number of employees, this will be a problem because a lot of time will be wasted on this payroll process.

For large-scale companies, paying by transfer is much better than paying by cash. The problem is that this less effective and efficient payroll software makes the transfer process problematic. It takes the best software that is able to transfer quickly and accurately.

Income Tax and Deductions

The problem that often occurs with the last payroll procedure and control is income tax and other deductions. As previously said, this payroll is a complicated process because there are many things to calculate, one of which is PPh and also this discount. As a good citizen, he must support tax-compliant government programs, which include other deductions in the form of health insurance, employment, old age security, and pension security. They all have different percentages.

To create a payroll process that is effective, efficient and free from problems, you can apply the best payroll software. Choose software offered by credible and experienced vendors like SOLTIUS. We are the best consulting company and IT provider in Indonesia. To solve problematic payroll procedures and controls and make them more effective and efficient, we have a solution in the form of SAP HCM which consists of several sub-components needed by your business, please contact us for more information.

Other News