Building a Secure and Scalable Open Banking Platform with SAP BTP Integration Suite

Modern banking is undergoing a massive transformation with the emergence of the open banking concept, which promotes openness, innovation, and collaboration. Existing regulations and ongoing global trends toward an API economy require banks worldwide to open access to their data and services to third parties while maintaining security and scalability.

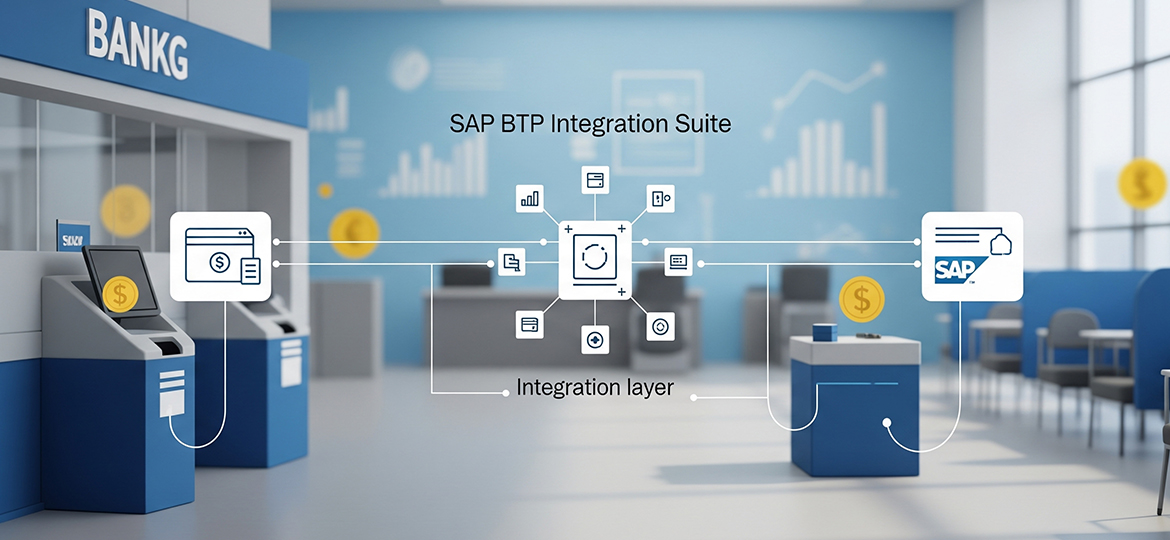

The SAP Business Technology Platform (SAP BTP) Integration Suite can be the solution for building a more secure and highly scalable open banking platform.

SAP BTP Integration Suite in the Banking World

SAP BTP Integration Suite is a cloud-based solution that simplifies the integration and creation of digital businesses across various aspects (applications, processes, data, and all systems within). In the banking world, this solution is a vital part of integrating a bank's core systems, digital applications, fintech partners, and other third-party service providers through APIs, event-driven architecture, and real-time connectivity.

Advantages of an Open Banking Platform

An open banking platform offers many advantages in the era of financial service digitalization, which focuses on collaboration, personalization, and efficiency. Here are some of the benefits of an open banking platform:

Faster Product and Service Innovation An open banking platform helps banks develop new services more quickly, provide innovative features without starting from scratch, and create a digital financial services ecosystem. This is thanks to easy access to the platform's architecture and APIs by third parties like fintech companies or business partners.

Personalization of Customer Services An open platform also enables the secure transparency of customer financial data. This can help in deeper analysis of user behavior and the offering of more relevant products (personalized loans, savings, rewards).

Operational Efficiency Creating an open bank can establish a series of automated processes for data verification, KYC (Know Your Customer), or credit scoring. This will impact cost efficiency for internal system development and maintenance. Furthermore, automation will speed up access to third-party services without needing to create separate access points.

Better Customer Experience With open banking, customers get a better experience thanks to a more transparent and faster integration arena. This allows customers to experience an end-to-end digital process for account opening, financing, and transactions, as well as access to financial services anytime and anywhere.

Better Security and Control Open banking built on a robust platform like SAP BTP offers security through encryption and permission management based on roles/positions. This makes it easier for the bank to conduct audits and monitoring.

The Role of SAP BTP Integration Suite in Modern Banking Challenges

SAP BTP Integration Suite has several features that enable banks to modernize both their features and operations. Here is how SAP BTP Integration Suite helps build a secure and scalable open banking platform:

Comprehensive and Flexible Connectivity As a platform for building banking services, SAP BTP Integration Suite supports many industry protocols. This simplifies the connection between the bank's core systems and third-party applications or open banking APIs, allowing the bank to launch digital services quickly without compromising the stability of legacy systems.

Integrated API Management The SAP Integration Suite includes API Management capabilities, allowing banks to create, manage, and monitor APIs securely. Each API can be controlled through policies for throttling, authentication, and encryption, thereby reducing the risk of data breaches and enabling clear audit trails. Additionally, APIs can be published on a developer portal to facilitate collaboration with fintechs or startups.

Advanced Security Advanced security can be achieved by utilizing the SAP Integration Suite. It offers several advantages such as end-to-end encryption, OAuth2 for authentication, and SAP Cloud Identity Services for integration with identity providers. These features ensure that only authorized users or systems can access the data and services shared through the platform.

Cloud-Native Scalability Built on a cloud-native architecture, SAP BTP Integration Suite can scale automatically according to workload demands. This is crucial when banks face transaction surges, especially during promotional campaigns or new service launches. The service also supports multi-cloud deployment, providing flexibility in choosing a cloud infrastructure.

Event-Driven Architecture Banks can utilize the event mesh and asynchronous messaging features to deliver real-time experiences for customers. Things like transaction notifications, credit approval statuses, or balance updates can be sent instantly, thereby increasing customer satisfaction and operational efficiency.

Conclusion

SAP BTP Integration Suite, as a platform for building open banking, is the answer to technological challenges that prioritize speed, security, and multi-user operation as the keys to competitive advantage in the digital era. SOLTIUS provides SAP Business One which can assist in developing a banking platform to produce secure and accessible banking services. Visit www.soltius.co.id now!

Other News