Causes of Payroll Errors, Procedures and Controls that Companies Must Avoid

Payroll procedures and controls - Payroll in this business requires more attention. That is because payroll is directly related to employee survival. Unfortunately, there are still many mistakes in the payroll process which result in losses at the end of the process. These mistakes can be trivial or unintentional to misuse that is carefully planned by irresponsible employees.

To be able to produce an efficient payroll procedure and control it is important to avoid these mistakes where most of the errors are caused by human error from staff or employees.

Causes of Errors

If the payroll procedures and controls are still done manually, there is a huge risk of this error. In general, it can be caused by three factors, namely the unavailability of complete, detailed, and clear procedures regarding a process. Lack of training provided by this company can also cause errors to occur in the payroll process. The next mistake is the lack of focus of the managing staff, especially the accounting staff, and the last one is a combination of various negligence that does not get sufficient supervision in the payroll process.

Why Are There Errors?

The next question is why these errors can occur? If you really delve into the day-to-day integrated process flow, analysis, and operations you will find a lot of mistakes that occur within the company. If you have never seen or found errors in the company, believe that the payroll process that is carried out in your company has not been integrated.

How To Make Payroll Procedures and Controls Run Effectively

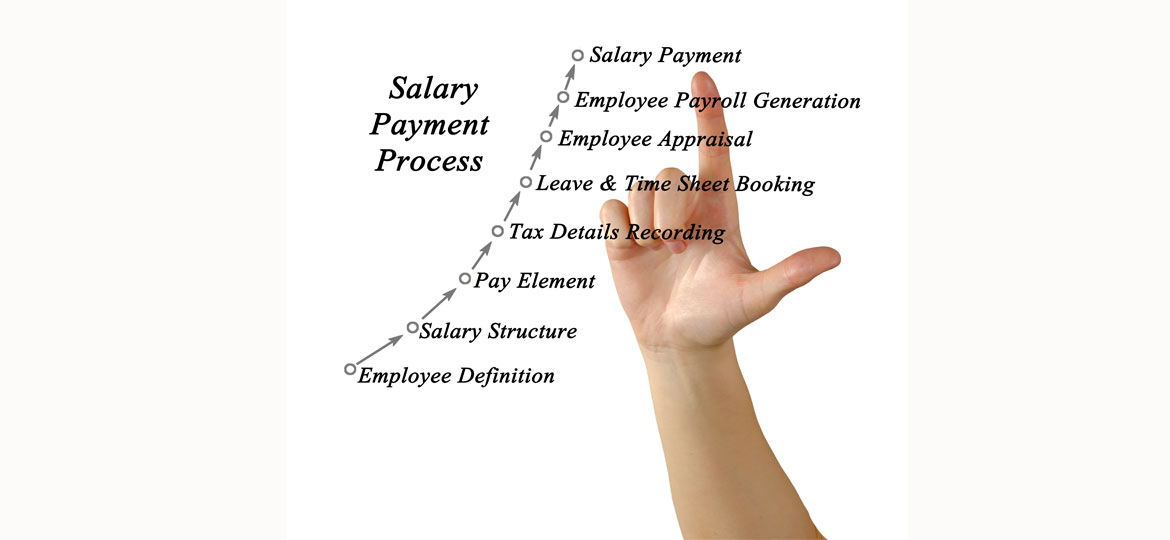

There are several internal control components that support control or control in the payroll system so that it runs effectively and efficiently, as follows:

Control environment

This control is carried out by the company because it is related to the characteristics of the management perspective. This control is important because it is the basis for making internal controls. The way to do this control is to create a company code of ethics, provide training to staff who have duties in the payroll system. There is a job assignment for each staff which consists of responsibilities carried out by the authorizing party and obtaining SOPs on payroll procedures.

Information and communication

In this payroll system, there must be clear information and communication between the company and the government so that the salary given to these employees is in accordance with applicable regulations. This information must be communicated to all company employees.

Monitoring

This management must monitor the ongoing payroll procedures so as to reduce fraud committed. It is important for companies to carry out continuous evaluations and correct procedures that are not executed or are not appropriate.

Activity control

There are four parts to the payroll procedure, namely hiring, documentation, authorization, and reconciliation. In recruiting employees must obtain prior approval from the authorities and there must be procedures in recruitment. The company must also have documents approved by each employee.

To be able to support effective and efficient payroll you can use SOLTIUS services. We are the best consulting company and IT provider in Indonesia. We have a solution in the form of SAP HCM to help your company's payroll system run faster, more effectively and efficiently. By using the solutions we offer you can not only maximize payroll procedures and controls in your company but also automate employee administration, time management, payroll and illegal reporting processes, contact us for more information or click on the following link: https: / /www.soltius.co.id/en/special-offer/read/hr-payroll-software

Other News